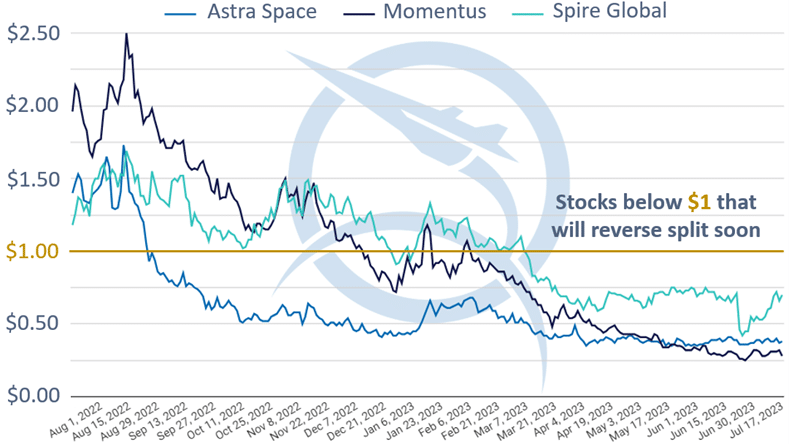

Spire (SPIR), Astra (ASTR), and now Momentus (MNTS) will likely pursue reverse stock splits, also known as stock consolidations, to boost their respective share prices. Spire and Astra investors have already approved the measure while Momentus stockholders plan to vote on it at an imminent special meeting. Companies execute reverse stock splits for many reasons. Most of them have to do with artificially boosting interest in a company and its stock so that analysts and institutional investors give it more attention. The other reason is because a company’s stock has fallen below $1 and may soon be delisted from their stock exchange, which is the case for these three NewSpace companies. Astra hasn’t been above $1 for almost a year while Spire and Momentus joined the unlucky delisting warning club this past March.

Reverse stock splits have no direct effect on a company’s operations, value, or market capitalization. The act simply redistributes a company’s equity among fewer shares by shrinking the total pool of outstanding stock, thereby increasing the price by a desired ratio. For example, Astra plans to move forward with a 1-for-15 reverse split. If it took place this past July 17th, a shareholder with 150 shares (priced at $0.38), would have a position worth $57 before the split. After the split, that same shareholder would have 10 shares, each worth $5.70, for a total, again, of $57. Spire is considering reverse splits between 1-for-2 and 1-for-50, while Momentus has yet to decide on a range.

All that being stated, stock splits do typically have material adverse effects on a company’s stock price as investors view it as an indirect sign of corporate woe. Should any of them decide to pull the trigger, SpaceWorks expects their respective market caps to have fallen by a few points once the dust has settled. Reverse stock split announcements from a few other companies on the NSI like Satixfy (SATX) and Sidus Space (SIDU), the latter having also received a delisting warning in March, are likely on the horizon as well.