SpaceWorks is pleased to introduce its first multi-part web series, “A Different Approach: Vertical Integration in the Small Satellite Sector”. This series explores the changing landscape for satellite manufacturers and how various market conditions have given way to a surprising uptick in vertical integration across the sector. Part I reviews the basics of vertical integration and examines why constellation architectures are changing the calculus around when and when not to vertically integrate.

Introduction

Manufacturing in the space industry has historically been a time consuming and expensive process, dominated by a small number of highly specialized firms. Behemoths such as Boeing, Lockheed Martin, and Airbus have held as much as 80% of the sector at certain times. Drawing upon deep technology heritage and industry expertise, these companies have held a relative oligopoly on spacecraft manufacturing and wielded their power to generate significant revenues.

With a traditionally heavy government customer base, high barriers to entry, and relatively low competition, manufacturers have had little incentive to pursue a vertically integrated manufacturing approach. Certainly, given the complexity of space systems, the appetite required to take on the additional technical risk associated with integrated operations would be enough to scare off any manufacturer. Not to mention, a vertically integrated strategy could, potentially, even lower a firm’s overall profit, if using a standard cost-plus government procurement approach.

Enter Elon Musk, Jeff Bezos, Paul Allen, and a host of return-hungry investors. Emboldened by the success of technology ventures, this new breed of space cowboy burst on the scene armed with significant capital and the expectation that each dollar be used efficiently, effectively, and with a purpose. These entrepreneurs cast aside the norms of the established space industry, exchanging extended development cycles for agile methodologies focused on reducing costs and trimming unnecessary company baggage. The results of these efforts has been astounding, causing a significant transformation in the launch industry not seen since the 1970s. Behind the success of SpaceX, Blue Origin, Stratolaunch, and others is a surprisingly consistent trend: vertical integration[1][2].

What is Vertical Integration?

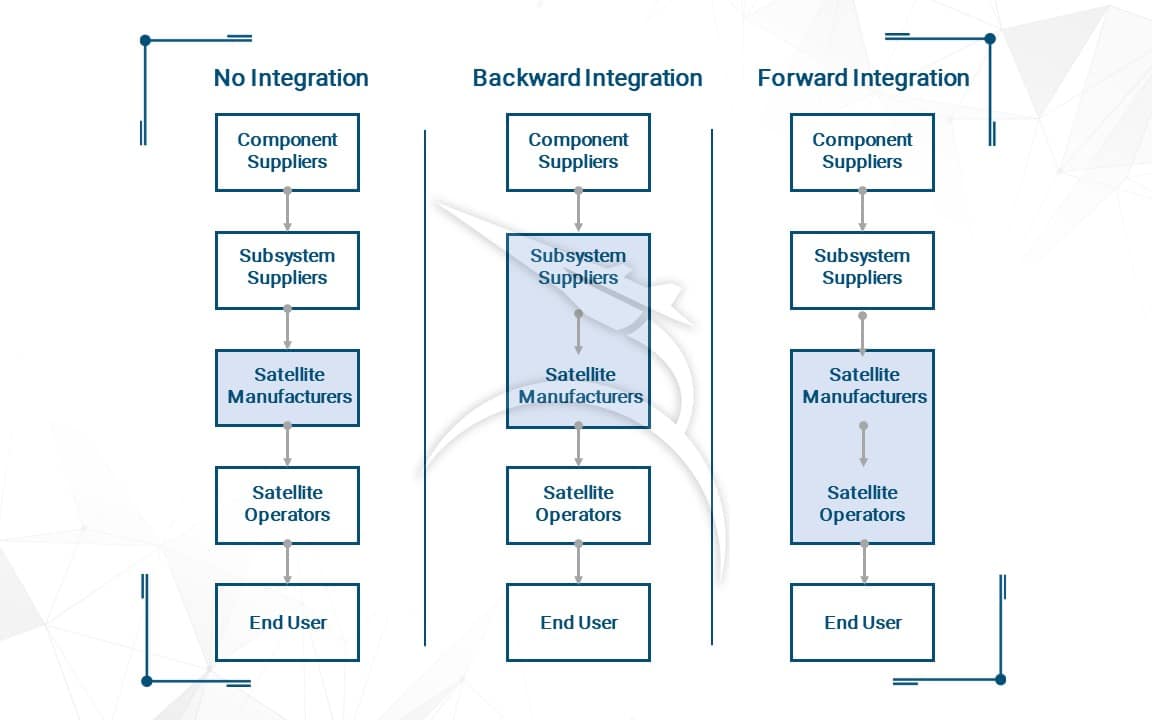

Vertical integration refers to a firm bringing additional elements of the industry value chain under common ownership[3]. Simply put, it involves bringing previously out-sourced operations in-house. Firms can vertically integrate both upstream (away from the end user, ex. into raw materials production) and downstream (closer to the end user, ex. into providing data analytics), depending on their relative location in the supply chain[4]; Figure 1 details this process in-depth.

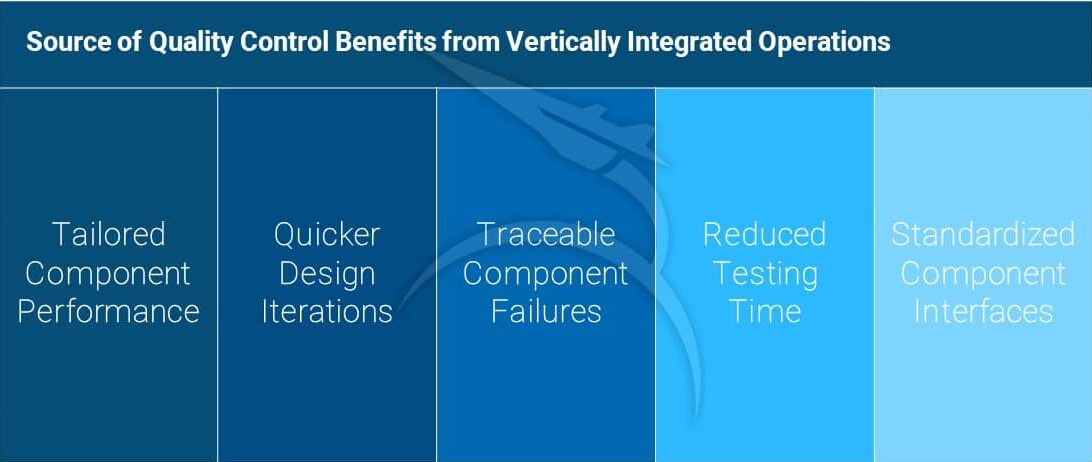

In industries such as Oil & Gas, a fully vertically integrated approach is not only common, but a necessity of doing business. In other areas, such as the automobile sector, firms may prefer quasi-integration approaches or its equivalents (such as long-term contracts). In general, vertical integration strategies are adopted as a means of increasing efficiency, controlling costs, and reducing 3rd party risk. The commonly cited benefits of vertical integration are detailed in Figure 2, though it is important to note that in order for the strategy to be effective, these incentives must outweigh the high setup cost and additional risks associated with integrated operations.

The Rise of Vertical Integration in the Satellite Sector

Nearly 15 years after the advent of SpaceX and Blue Origin, the space industry is almost unrecognizable. The Constellation program is long gone, LEO has replaced GEO as an investor’s playground, and large, performance-driven platforms are being replaced by swarms of small satellites. Where before there existed a culture of mark-ups, downward pricing pressure and a shift towards commercial revenue streams has spurred increased interest in maintaining cost effective and efficient operations.

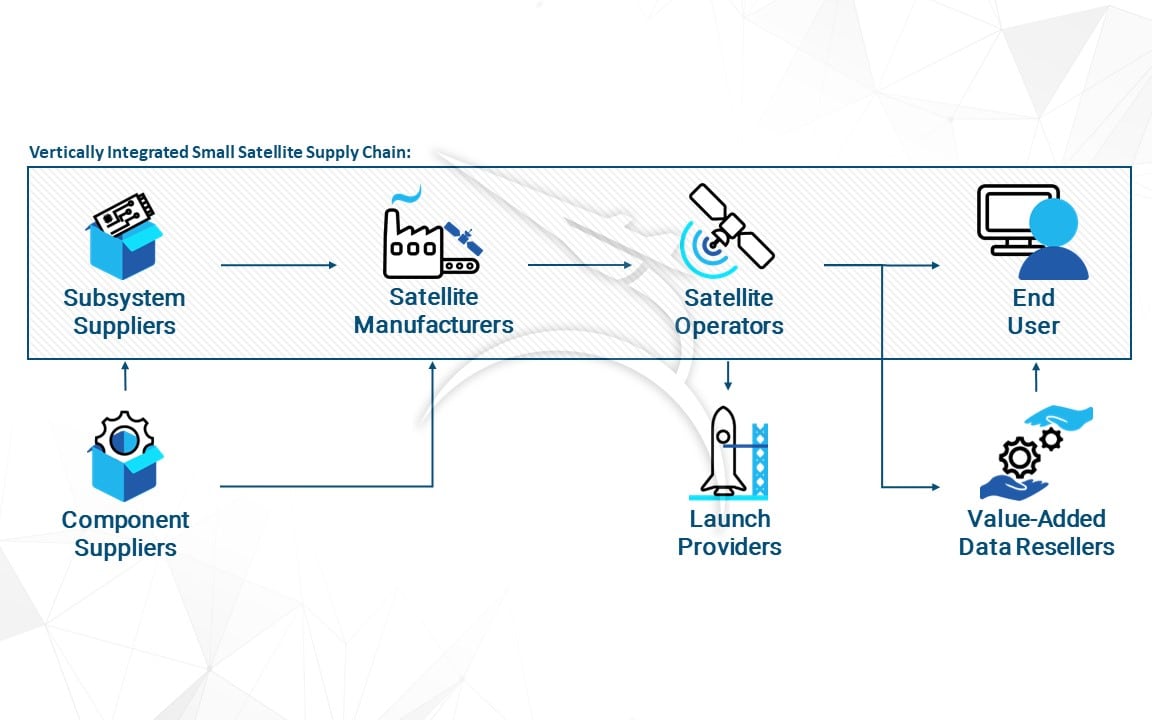

Driven in no small part by vertical integration activity in the launch sector, the satellite sector is now beginning to show a greater propensity to manufacture, integrate, operate, and even manage end user sales entirely in-house. Particularly in the small satellite segment, major players such as Planet, Spire, and GomSpace have already at least partially adopted this strategy, and SpaceWorks research suggests many more firms are still to follow.

The allure of vertical integrated operations, a la SpaceX, is hard for satellite manufactures to resist. An increased focus on large, disaggregated satellite constellations (vs. single, highly capable spacecraft), contributes to the need for economies of scale to close capital-intensive business cases. Inconsistent component suppliers additionally provide headaches that vertical integration promises to resolve. For many in the small satellite segment, it may even be an imperative in order to develop the emerging markets they hope to serve.

Still, vertical integration is a costly, and near irreversible corporate strategy, with significant associated risks. While the benefits can be great, firms that fail to effectively implement put themselves at an extreme disadvantage, one that could be costly in an industry where first-to-market firms seem to trump fast-followers more often than not – a fact not likely to be lost on CXO teams. So what is it that makes vertical integration suddenly so compelling in an industry that once seemed to barely know such a strategy existed?

In attempt to better understand the corporate motivations behind the rise in vertical integration across the satellite manufacturing sector, SpaceWorks undertook a multi-part study investigating how internal and external control, risk, and changing industry trends are changing the way satellite manufactures operate. Originally presented at the NASA Cost & Schedule Symposium, this continually evolving series is intended to help satellite industry executives fully understand the framework surrounding decisions to vertically integrate.

Part I: A Necessary Evil

With the rise of the small satellite sector has come an industry-wide shift towards disaggregated, constellation architectures. This shift has caused significant ramifications across the greater satellite manufacturing sector – perhaps the most publicly visible was Maxar’s shocking announcements that they would be winding down their GEO division to focus entirely on small satellite production[5].

As traditional giants like Maxar go back to basics and remind themselves of the lessons from the lean revolution, more agile start-ups, such as Planet and Spire are leaning on the software revolution to power their efforts[6]. Regardless of the inspiration, one thing is clear: the name of the game is efficient manufacturing. For the operators pursuing large constellations, economies of scale are not a luxury, but an absolute necessity.

The vast majority of these companies are not deep-pocketed government agencies or telecos, but enterprising start-ups with limited runway. These organizations are thinking in weeks or months, not years or decades… a far cry from the traditional development times associated with the satellite industry. Not only do they face shorter timeframes, but, SpaceWorks research suggests, they are on average looking to launch as many as 50 satellites per year. Closing a business case requiring hundreds of satellites to be produced and launched every few years is a tall order without running an incredibly lean operation.

Still, building satellites is not as simple as assembling circuit boards. There is a reason why vertical integration failed to gain traction in the satellite manufacturing sector of the late 20th century… tribal expertise, proprietary testing procedures, and established processes all helped to protect traditional manufacturing firms from vertically integrated new entrants. With the influx of small satellite constellations, however, traditional manufacturing may have met its match. While smaller constellations almost certainly make sense to be produced using traditional approaches and established firms, SpaceWorks research suggests that the vertical integration breakeven point may not be as high as one would expect.

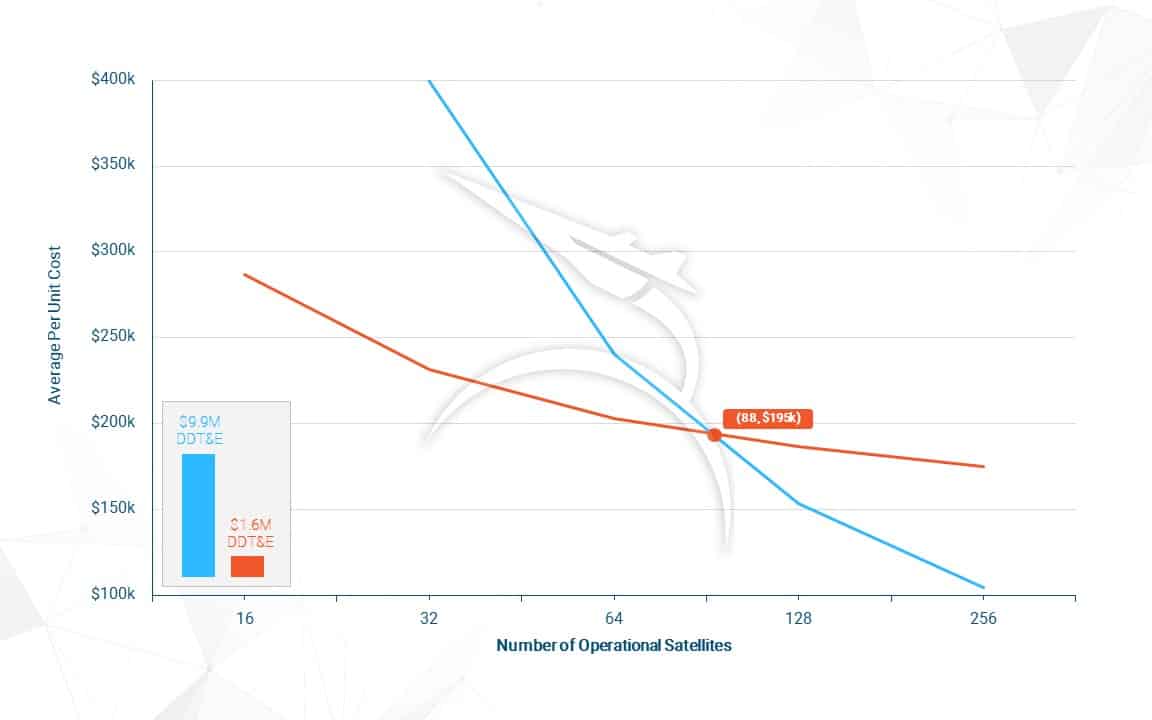

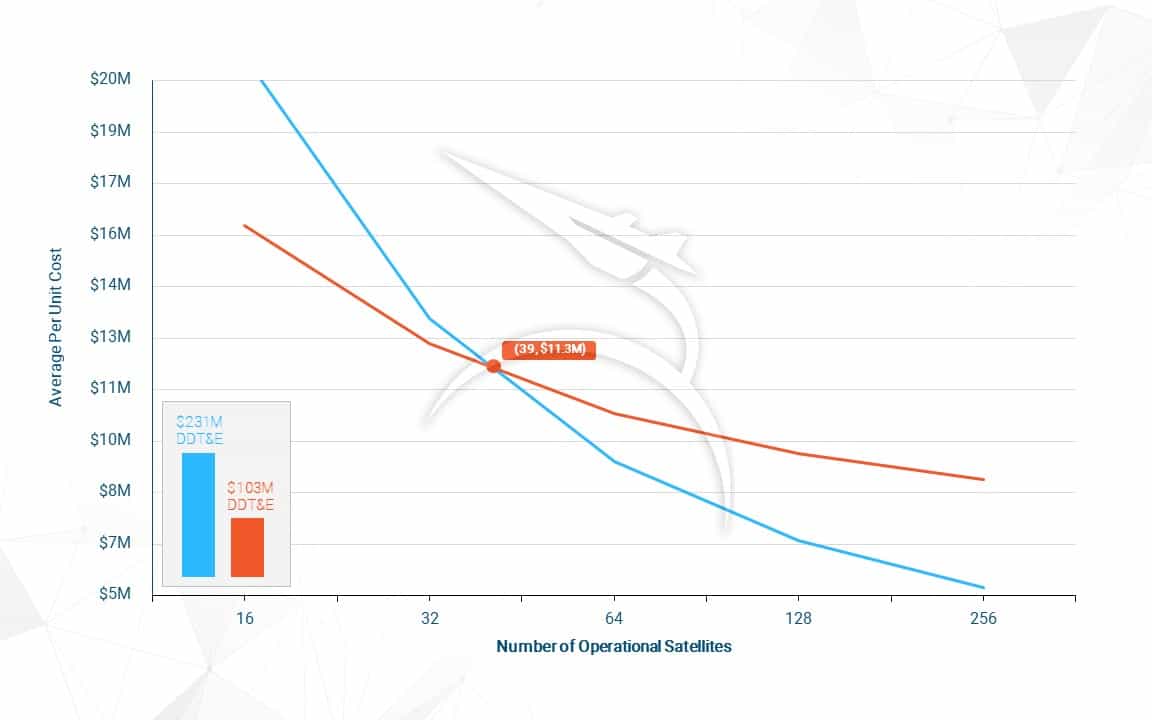

In Figures 4 & 5, SpaceWorks explores the costs of hypothetical 3U and 300 kg communications satellite constellations under different manufacturing approaches. In both cases, costs were estimated parametrically, based on a master-equipment-list provided by the engineering team at SpaceWorks. The average per unit cost (APUC) reflects the total development and production costs of the constellation, amortized across the number of operational satellites.

APUC is initially quite high for the vertically integrated approach, reflecting the upfront costs associated with building of new facilities, processes, etc. Overtime, as the manufacturer begins to achieve significant economies of scale, APUC drop significantly, and at a much quicker rate than traditional manufacturing. SpaceWorks’ research suggests that because firms are able to absorb nearly all of the surplus from learning effects (no sharing with suppliers), and can more easily accelerate their development timelines, they are able to dramatically reduce costs.

For the 3U satellite constellation, these results suggest that at approximately 88 satellites the vertically integration manufacturing approach breaks even with a traditional manufacturing approach. Given the average 3U constellation is close to 150 satellites, this has an important implication for operator-manufacturers: if you are not looking at vertically integrated approaches, you may be leaving money on the table.

This number may be far lower in larger satellite constellations. A similar analysis of a hypothetical 300 kg communications satellite constellation yielded a breakeven point at just 39 satellites. A number of factors contribute to the lower breakeven in this segment, including more gradual learning effects, and higher development costs for both traditional and vertically integrated approaches. Given that these types of satellites are an order of magnitude higher in per-unit cost, it is understandable why capital constraints have prevented this segment from overly embracing a vertically integrated strategy, but these results suggest it may actually be worthwhile. The implication for operators of larger satellite constellations is that despite their high upfront expenditures, vertically integrated approaches can rapidly make up for higher initial setup costs.

Of course, per unit cost is only one part of a much more complicated equation that must consider the time value of money, enterprise risk, and realistic capital constraints. It appears, at least initially however, that achieving economies of scale could be a significant motivator for choosing a vertically integrated manufacturing approach. Particularly for companies pursuing large satellite constellations (100+), the rewards can be great, despite significant challenges associated with such an approach.