Introductions

In 2019, SpaceWorks published “A New Era for Orbital Debris Policy”, which expounded on the orbital debris problem, the historical policies aimed at addressing it, and a recommended policy framework based on the associated costs of debris removal. Like many other facets of the space industry, the conversation regarding orbital debris has been marked by drastic changes over the past four years. This article provides an update on the proliferation of orbital debris, the associated challenges, an analysis to support future rulemaking, and some recommended paths forward.

Overview

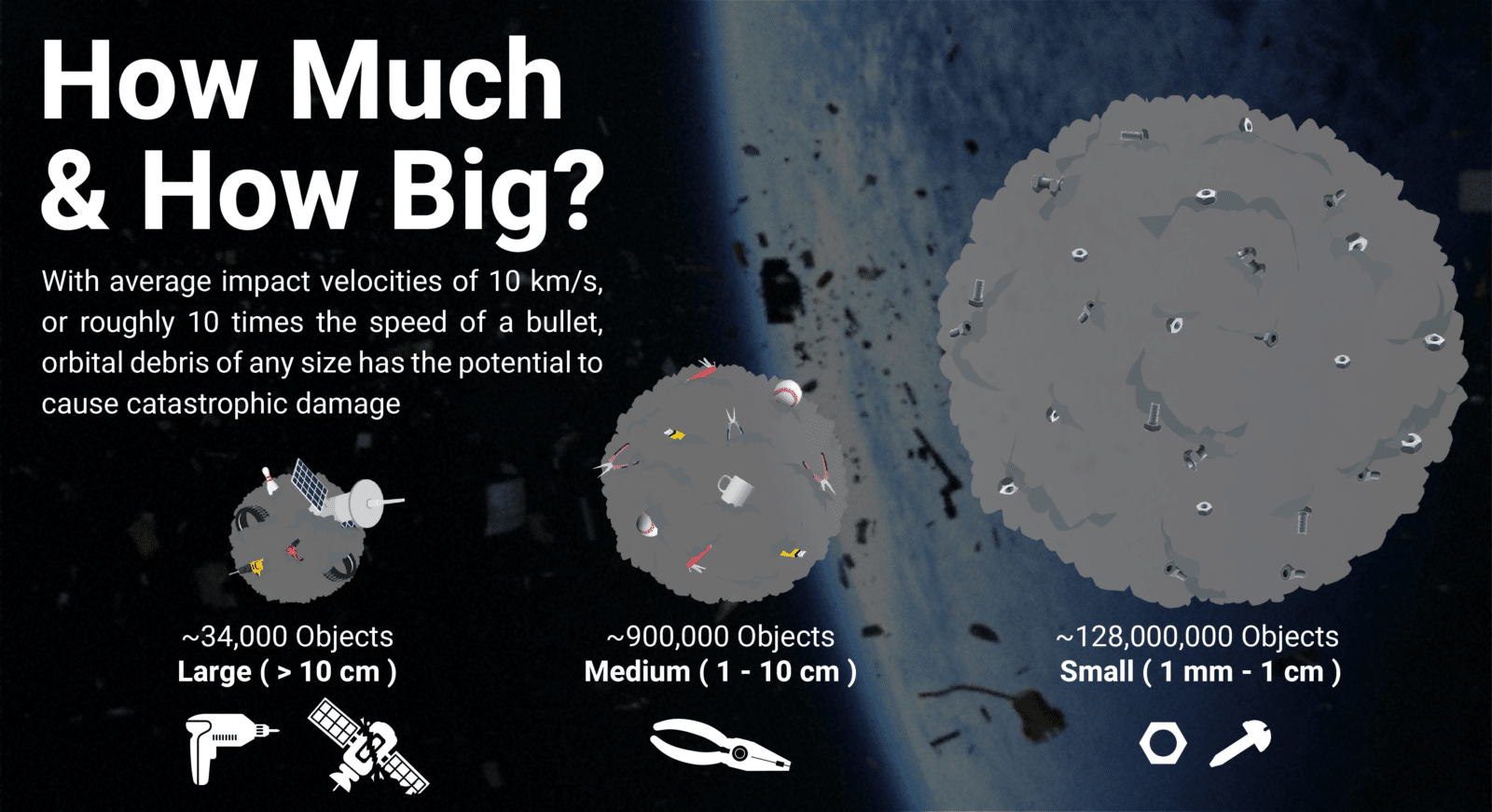

The proliferation of activity in cislunar space over the last fifty years has resulted in an exponential increase in the quantity of orbital debris or “space junk” circling Earth. According to the European Space Agency’s Space Debris Office, there are ~34,000 objects greater than 10 centimeters, over 900,000 objects from 1 centimeter to 10 centimeters, and 128 million objects from 1 millimeter to 1 centimeter in diameter.[1] With average impact velocities of 10 km/s, or roughly 10 times the speed of a bullet, orbital debris of any size has the potential to cause catastrophic damage. As the amount of space debris continues to increase, members of the space community often refer to the “Kessler Syndrome”, which theorizes that when Earth’s orbit surpasses its capacity to sustain debris, an uncontrollable cascade of collisions will render it permanently unusable.[2] Companies have implemented debris mitigation efforts. However, the biggest risk isn’t two operating satellites colliding, but rather two uncontrolled objects colliding that makes active debris removal paramount.

Currently, there are around 20,000 near-collisions between operational satellites and orbital debris in Earth orbit per week. Definitions of near collisions vary between agencies and organizations but can range from a couple of meters to several kilometers.[3] Projections indicate that by 2050, near-collisions will reach 50,000 per week if debris removal does not exceed current levels. Furthermore, it is predicted that by 2050, at least one collision involving a debris object larger than 10 cm will occur every five years.[4]

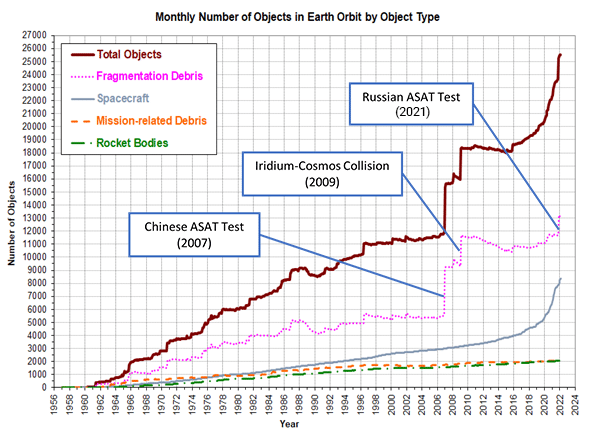

Among the 86 nations that either currently have or have previously launched objects into space, the United States (33.6%), the former USSR (32.7%), and the People’s Republic of China (28.6%) are responsible for nearly 95% of all debris in orbit.[5] As seen in the figure below, the problem has also been drastically exacerbated over the last few decades by purposeful antisatellite (ASAT) weapons testing, which can create fragmentation debris clouds filled with thousands of new objects.

Active debris removal (ADR) and space situational awareness (SSA) are two central approaches of addressing orbital debris. SSA involves identifying the objects, tracking their orbits over time and more specifically, providing the necessary velocities and trajectories needed to close in on the object. This data then enables ADR efforts to be carried out. The three primary methods of ADR are evaporation (laser radiation), alternative orbit propulsion (rocket or electric) and deceleration of debris (braking devices or maneuverable tugs).[6][7] All of these methods ultimately evaporate or incinerate the debris upon entering the atmosphere.

Current Regulatory / Policy / Legal Regime

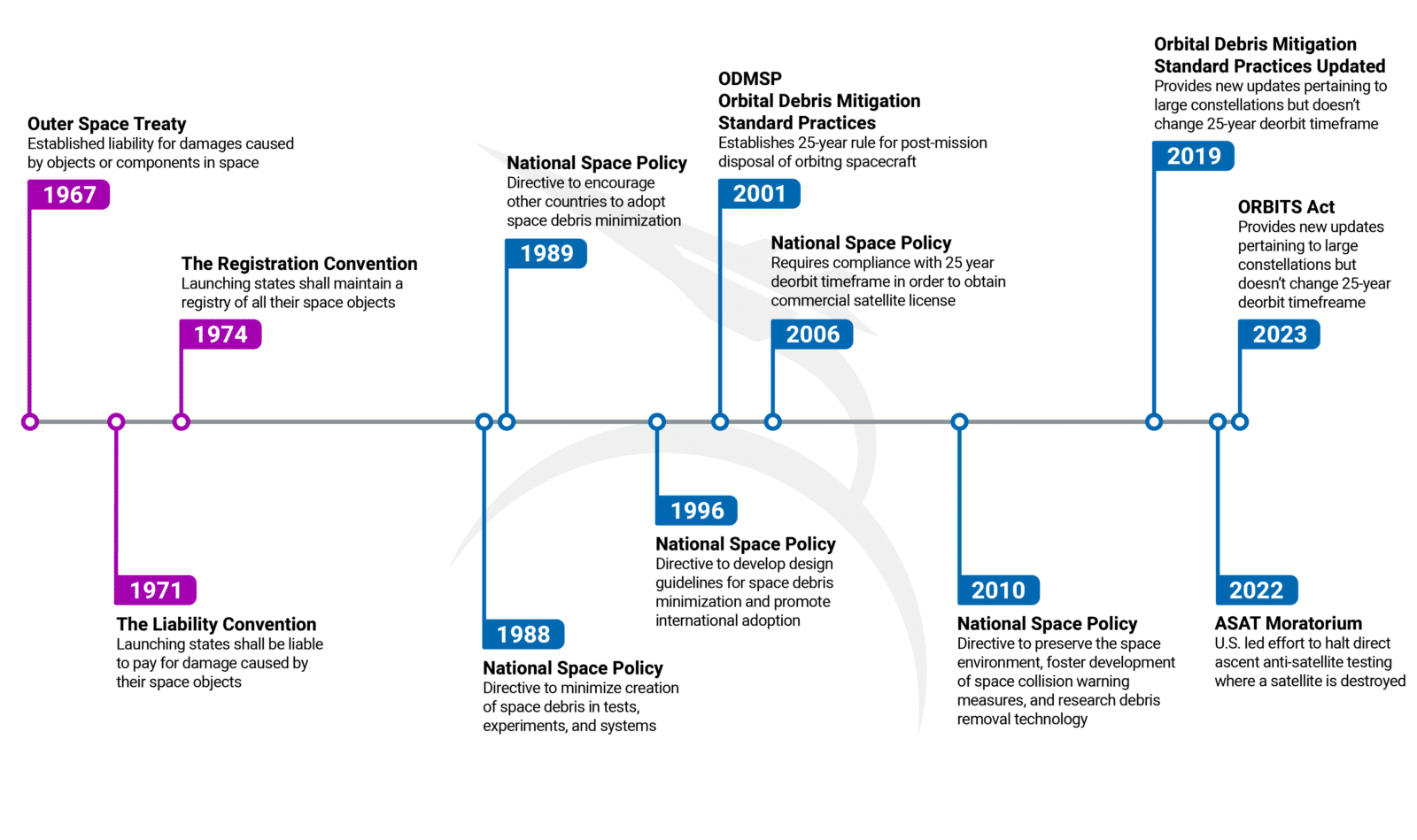

There is currently no international treaty that multilaterally governs the creation of new and management of existing space debris. However, there are three relevant treaties which do outline the problem of orbital debris:

- The Outer Space Treaty (1967)

- The Liability Convention (1971)

- The Registration Convention (1974)

Beyond this foundation, both the Inter-Agency Space Debris Coordination Committee (IADC) and the United Nations Committee on the Peaceful Uses of Outer Space (COPUOS) first published Space Debris Mitigation Guidelines in 2002 and 2007 respectively. While the IADC has 13 national space agency members and COPUOS now boasts 102 member states with more than 50 observing organizations, all the guidelines provided by both entities are non-binding.[8] Recommendations continue to pour from different organizations such as The World Economic Forum, which published specific post mission disposal, data sharing, and collision avoidance targets in June of 2023. Finally, there are the individual countries, departments, agencies, and private companies that directly address each party’s respective regulation of orbital debris. Even the US Department of State and Department of Defense currently have different recommendations. The result is a complex collage of unilateral and mild multilateral arrangements that help pool resources for solving the problem of orbital debris, but no obligatory international regime explicitly designated to oversee it.

Ongoing Challenges of ADR

Policy Gaps

Article VIII of the Outer Space Treaty and the Registration Convention lays the legal foundation for interacting with foreign space objects, as it states that the ownership of objects is upheld regardless of their location in orbit or on Earth. While debris is not explicitly defined, these frameworks have led to a de facto understanding that it is unlawful to interfere with another nation’s debris.[9] Also, international law offers no enforcement mechanism that requires countries to remove their own debris. Since existing policies only offer recommendations, not only is there a lack of incentive to address their own debris, but without an established framework, there is arguably an active disincentive for any stakeholder to address another country’s debris. Additionally, the ever-increasing number of countries with satellites in orbit has resulted in a patchwork of communication standards and data sharing criteria. This has created a murky and intricate global system of SSA where everything from what constitutes a potential collision event to who has the “right of way” when an event occurs is still up for debate.

Technology Hurdles

The technical challenges of removing debris primarily depends on its size. Most stakeholders group orbital debris into three size categories: small (<1mm), medium (1mm-10 cm), and large debris (10cm>).[10] Spacecraft can be designed with protection from small debris and even without that additional shielding, mission-ending damage is unlikely. Large debris is the easiest to track and mitigate. However, many ADR methods still lack the required precise navigation and maneuvering to interact with it in orbit. Fully autonomous systems are still in development and remote-operated vehicles are not yet feasible due to the time delay and complex dynamics of space-based robot mechanics. Finally, medium debris has been identified as the size most likely to cause catastrophic damage due to their high quantities and orbital dynamics.[11] Innovative ADR technologies to address this troublesome size include giant nets, physical sweepers, magnetic systems, and laser brooms. Most of which are still in the conceptual or demonstration phases of development.

Economic Barriers

Since orbital debris represents an externality, it is not clear who should or will pay for ADR services. Because of this, ADR focused companies have historically had little ability to develop their technologies beyond what government funding can provide. This is well short of the capital required to address the previously stated complex technical hurdles and reach a scale where the price of ADR services becomes attractive to customers. A current example of this scenario is the European Space Agency’s funding of ClearSpace-1, which is being designed by the Swiss firm, ClearSpace. This mission aims to remove a 112 kg Vespa upper stage payload adapter from LEO. The total estimated cost to remove this single piece of debris is $102.0M.[12] Another ADR services company, Kall Morris Inc. (KMI), recently advertised that they would charge anywhere from $4.0M to $62.5M per object for removing 52 U.S owned piece of large debris from LEO. These steep figures indicate that ADR is still an emerging industry, and it will remain so until an effective policy framework is implemented which creates a common pool of funding to pay for it.

Analysis

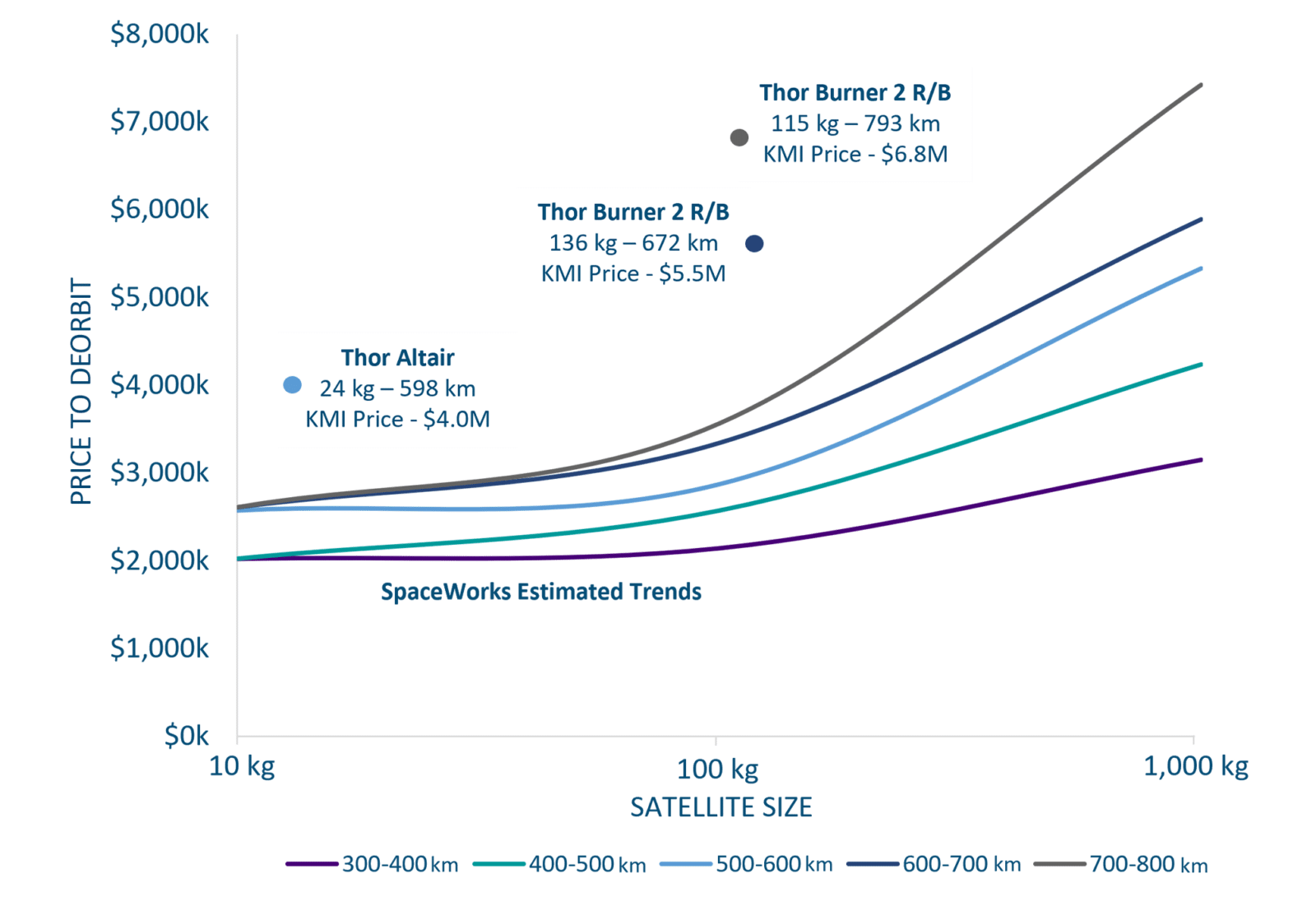

A reoccurring theme in recent policy discussions is the need to create a regime that both motivates the industry to act and avoids impeding market growth. In our previously published article, we analyzed the costs associated with conducting dedicated deorbit missions for satellites in LEO using a non-reusable chemically propelled space-tug. This was used to determine the point where firms would be indifferent to paying a regulatory fine versus paying for deorbiting services. Assuming 100% utilization of the satellite, these costs ranged from approximately $220K to $870K in 2019 for a satellite of less than 1,000kg. KMI’s recent advertisement for ADR services presented new data for comparison. The pricing trends below have been updated from our 2019 estimates with the following changes:

- Escalated to 2023 dollars

- 10% utilization rate to better reflect current ADR market demand

- 25% ADR service provider profit margins

- (3) of KMI’s advertised ADR prices included for comparison

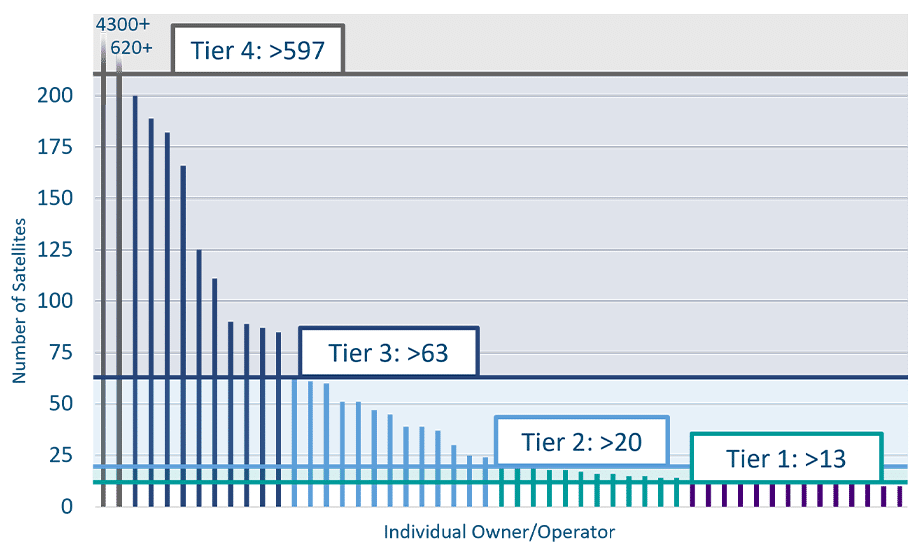

The (3) KMI prices are approximately 38% higher on average than the corresponding SpaceWorks estimated trend lines. The difference can be attributed to KMI’s unique amortized development costs, operational costs, profit margins, and ADR vehicle utilization. As expected, the KMI prices increase with debris mass and altitude. The (2) Thor Burner 2 Rocket Bodies with similar masses also offer an interesting comparison. The 121 km increase in altitude results in an additional $1.3M. A 24% increase in price. This new data supports our previous assertion that policies with a tiered incentive framework based on the object’s physical and orbital characteristics is necessary. Policies should also be based on the number of satellites that each operator/owner currently has in-orbit to avoid creating barriers to market entry and fairly distribute the costs of both ADR and SSA. This will allow new private companies and countries with burgeoning space programs to conduct the necessary demonstration flights and initial missions when their budgets are the most sensitive to incidental expenses. On the other end of the spectrum are the more financially stable and well-funded mega-constellation operators who also represent the largest potential orbital debris impact. As of June 2023, there were about 7,300 satellites in LEO. The figure below represents the approximate distribution of those satellites among the top 50 owners/operators along with proposed quantity tiers based on the statistical quartiles and the standard deviation. While our previous analysis focused on a regulatory fine-based framework, a tax-based framework is also plausible.

Conclusions and Recommendations

Orbital debris has been around nearly as long as man-made satellites themselves. The relatively low risk it posed in the 1970s reflects the corresponding voluntary nature of policies implemented in that era. More than half a century later, these outdated guidelines and recommendations have led to an exponential increase in orbital debris for two reasons. First, because the benefits that an individual firm or country may receive from following them do not ultimately outweigh the financial costs. Second, because the cost to build, launch, and operate satellites has drastically decreased, and will continue to do so such that a 10x increase in the number of satellites is forecasted by 2030.

Terrestrial Air Traffic Control (ATC), whose primary mission is to prevent collisions in the aviation industry, isn’t funded by fines but rather by excise taxes on passenger tickets, cargo, and fuel in the United States. Similar tax structures are employed around the world. All stakeholders contribute a nominal amount to ensure continued industry safety and public trust. A similar mandatory progressive tax framework based on satellite mass, satellite orbital characteristics, and the number of satellites under control of the owner/operator would incentivize them to deorbit inoperable satellites while creating a common pool to fund SSA and ADR. This will limit the creation of new orbital debris while creating the market forces needed to breach the economic and technological barriers. Opportunities for global collaboration are on the horizon. The recently published Policy Brief on the Future of Outer Space Governance by the United Nations is encouraging and SpaceWorks looks forward to discussions on compulsory debris policies at the United Nations Summit of the Future in 2024.

Aaron Boysen | Senior Economic Analyst

Mr. Aaron Boysen is a Senior Economic Analyst at SpaceWorks. His past experience includes 14 years in multiple engineering and market analysis roles at the Boeing Company. He holds a BS in Aerospace Engineering from the University of Minnesota and an MBA from the University of Washington. Mr. Boysen specializes in aviation, high speed flight, and commercial LEO markets.

Austin Humphrey | Junior Economic Analyst

Austin Humphrey is a Junior Economic Analyst (intern) at SpaceWorks. He holds a BA in International Affairs from Mercer University, and he is currently pursuing an MS degree in International Affairs with a Certificate in International Security and Aerospace Systems from the Georgia Institute of Technology. His areas of interest include aviation, international space policy, and space debris mitigation.