Introduction

Over the past decade, people around the world have experienced a dramatic shift towards increased usage and reliance on internet services. Further heightened by the COVID-19 pandemic, dependence on internet services has highlighted an increased need for connection accessibility in rural and urban communities around the world. In response, terrestrial internet service providers (ISPs) are working to expand their internet networks and implement new technologies such as fiber optic cables to deliver greater coverage and higher speeds to more communities. However, terrestrial broadband faces geographic limitations, and individuals living in remote areas cannot easily access ground-based internet. In fact, 27.6 million households (22.5% of total households with an average of 2.5 people per household) in the United States don’t have home internet, and 35% of rural residents in the U.S. still do not have access as of April 2021 [1]. To address this large customer market, satellite ISPs are building constellations that will provide nearly global coverage. It remains to be seen if these remote markets are robust enough to support satellite ISPs and if satellite speeds will ever be fast enough to compete with terrestrial ISPs.

GEO vs LEO

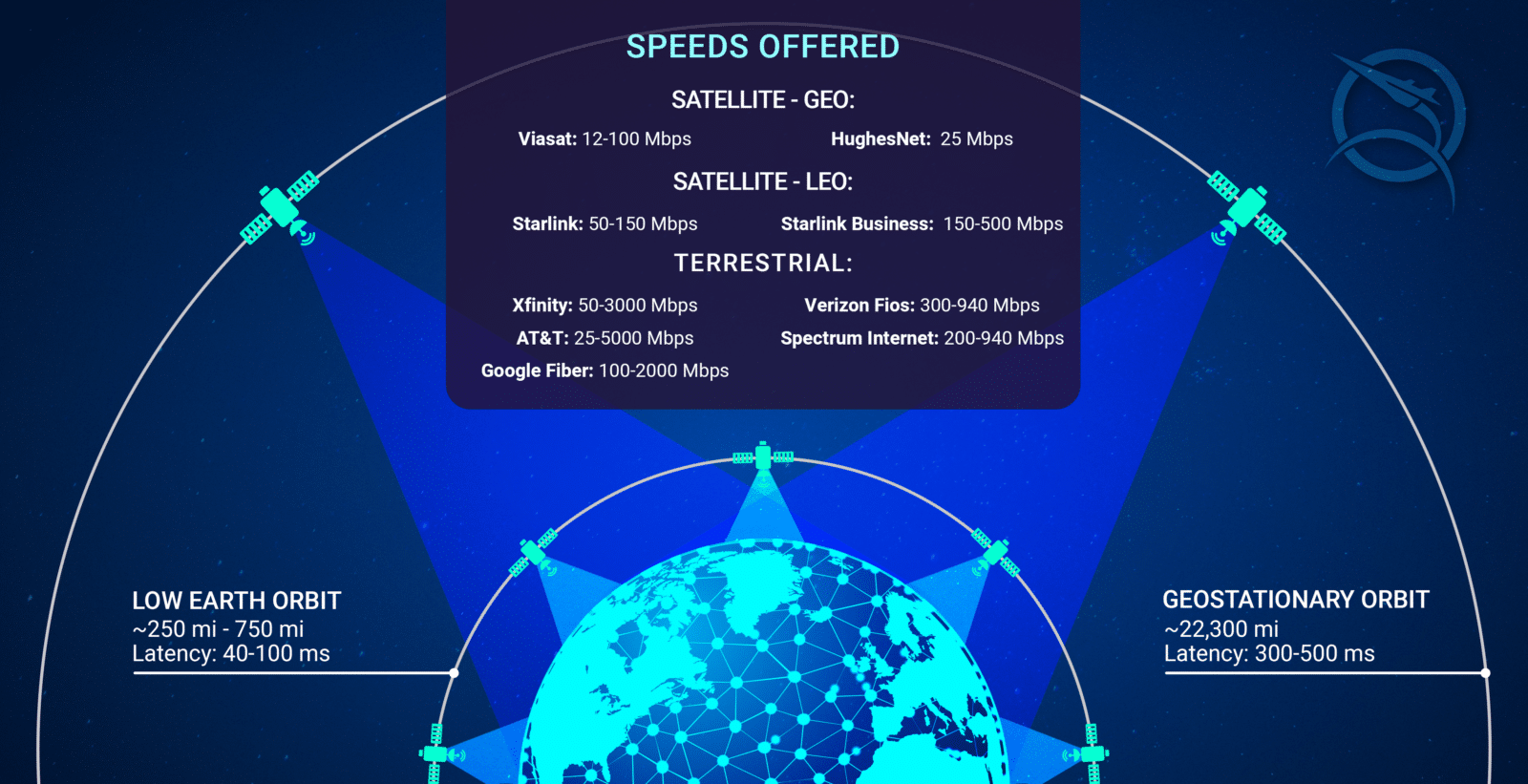

Traditionally, satellite ISPs, such as Viasat and HughesNet, have used large satellites placed in geostationary orbit (GEO) where only a few satellites are needed to provide services with near-global coverage. However, the latency and speeds that these satellites can deliver are relatively poor given their distance from the Earth’s surface (~22,300 miles). Recently though, companies such as SpaceX have been developing and deploying large constellations in low Earth orbit (LEO) to provide satellite internet services. In LEO, satellites are much closer to the surface (<1,200 miles) and can therefore deliver faster speeds and lower latencies. See Figure 1.1 for orbit comparisons. Being closer though means that significantly more satellites are needed to provide global coverage and maintain constant connections with consumers. SpaceX currently has approval for 4,408 Starlink satellites with more than 2,000 already launched and is awaiting approval for a 30,000-satellite constellation [2].

Satellite vs. Terrestrial

For those areas with the necessary infrastructure (i.e., major cities), terrestrial broadband is the preferred choice given the fast speeds, low latency, affordability, and reliability it provides. Satellite ISPs are improving their services to compete with terrestrial broadband companies such as Xfinity, AT&T, Verizon, Google, and Spectrum but as of 2022, there is a large discrepancy in the highest internet speeds they offer (Figure 1.1). To compare, of the five largest terrestrial ISPs, the lowest maximum speed offered is 940 Mbps while the highest maximum speed amongst satellite ISPs is 500 Mbps (Starlink business plan). At the top end, terrestrial ISPs even offer up to 5000 Mbps (AT&T), 10 times the maximum speed offered amongst all satellite ISPs. There is some overlap in cost when looking at monthly plans (Figure 1.2) but when costs are normalized with respect to speed, terrestrial ISPs display much better costs for the speeds they offer (Figure 1.3). On top of this, the fastest satellite internet via Starlink includes a steep one-time equipment charge of $2500. This makes satellite ISPs non-competitive in terms of cost, speed, and latency in developed areas with the infrastructure to support terrestrial internet services.

However, for individuals in remote locations, cable-based internet service may not be an option. Coverage is an aspect where satellite ISPs have a significant edge. Comparing United States population coverage metrics reveals the advantages that satellite constellations have with no geographic limitations (Figure 1.4). Both Viasat and HughesNet boast a population coverage of ~308 million people in the USA. Starlink claims near-global coverage, but services are limited to countries that have given their approval. In contrast, AT&T, the ground-based provider with the largest U.S. coverage, covers only 121 million people. It is important to note that because of terrestrial ISPs’ limited fiber-optic cable networks, their highest speeds are not offered in most locations. This accessibility difference plays a role in 35% of rural residents in the U.S. still lacking high-speed internet access. Even with lower speeds and higher prices, this is a large reason why satellite ISPs can service a substantial customer base in the United States and around the world. (Coverage metrics were gathered for most companies from BroadbandNow [3])

In the United States, populations tend to be clustered in large cities and urban areas where terrestrial ISPs have focused their infrastructure. At the end of FY2021, the five largest terrestrial ISPs serviced more than 84 million users while the three biggest satellite ISPs serviced less than 3 million. Given terrestrial ISPs’ higher speeds and lower costs, they face little, if any, competition from satellite ISPs while also generating higher revenues with their larger customer bases (Figure 1.5). Internet service revenues for terrestrial ISPs grossed over $62 billion combined while satellite ISPs grossed just under $3 billion (no official revenue data for Starlink). (Internet revenues and customer numbers were pulled from current and past 10-K and 8-K filings [4].

Monthly data caps are another important metric that consumers in today’s data-intensive society truly care about since it dictates how much capacity they can utilize. Caps vary based on plan and internet provider but expect to see 40-150GB/month for Viasat and 15-75GB/month for HughesNet. To compare, terrestrial broadband companies such as AT&T, Verizon, Spectrum, and Google have unlimited data and providers with caps like Xfinity feature 1.2TB/month caps [5]. Starlink differentiates itself from other satellite ISPs by also offering unlimited monthly data.

Looking Forward

The internet industry as a whole has generally seen upward trends in its customers and revenues due to nominal population growth and increased internet reliance. Looking ahead to 2026 and beyond, we expect to see terrestrial ISPs maintain this upward trend in their revenue and customer numbers (Figure 1.6, 1.7). Xfinity and Spectrum are expected to grow moderately with technological improvements and infrastructure expansion. We expect to see customer base growth rates at an average of 6% annually and revenue growth of 8-14% year over year. Although customer growth rates are roughly the same, Spectrum’s higher pricing of their low-end services leads to higher projected revenues compared to Xfinity. AT&T’s recent customer numbers show a slight plateau, but with expanding networks and greater fiber accessibility we expect to see an approximate 6% annual revenue increase as that plateau veers into slow growth. Recent trends predict that Viasat and HughesNet show minimal to no growth with a possible decline in customer numbers. This is a result of lower speed offerings and higher $/Mb metrics than their terrestrial and satellite competitors. However, HughesNet seeks to reach speeds of 100 Mbps (up from the current 25 Mbps) with a new satellite deployment which will likely lead to the growth of their business [6]. Based on recent rapid growth trends, we predict Starlink to grow more than an average of 500% annually and boast over 3 million users by 2026.

Starlink’s goal to offer 10 Gbps [7] and feature global capacity in the coming years could make them a legitimate alternative to terrestrial broadband companies that face geographic and country boundary limitations. The terrestrial ISPs mentioned look to increase coverage in the United States by expanding the fiber optic cable networks to access more rural communities. Based on increasing fiber internet availability trends, it is expected to see speeds of 1 Gbps to 5 Gbps become more accessible to those away from large cities. With expectations of technological improvements in the coming years, speeds will follow suit and more providers will offer speeds of 2 Gbps and higher. Many of these companies such as Xfinity and Spectrum are even developing, testing, and implementing advanced fiber cables that would sustain 10 Gbps speeds [8, 9]. This path to improvement could prove dangerous to satellite ISPs as terrestrial broadband coverage and speeds encroach on satellite ISPs’ customer bases.

A Fast-paced Landscape

The satellite constellation and internet industry are set to be very competitive in the coming years. Major companies and governmental organizations are looking to bear the high infrastructure costs and enter the market. Amazon has been developing its own internet service named Kuiper which will feature a 3,236-satellite LEO constellation and offer up to 400Mbps to ordinary internet consumers. They recently signed billions of dollars’ worth of contracts with several launch service providers to launch their constellation over the coming years [10]. OneWeb, another global communications company funded largely by the UK government, is nearing completion of its 648-satellite LEO constellation which will offer services to communities, governments, militaries, and businesses. Similarly, the US Defense Department’s Space Development Agency recently awarded nearly $1.8 billion in contracts to Lockheed Martin, Northrop Grumman, and York Space Systems to produce a LEO global communications network of 126 satellites to support military communications and operations [11].

On the other hand, governments such as the United States have invested billions of dollars into improving terrestrial internet accessibility and capability through recent infrastructure bills [12]. The Infrastructure and Jobs Act, signed into law in August 2021, included about $65 billion to improve terrestrial broadband internet access in isolated communities and make it more affordable for low-income individuals. $42.5 billion of this money will go into improving internet access and speeds in lacking areas of the country. Each state is guaranteed at least $100 million in funds to help with many states receiving more. These funds would help subsidize the approximately $80 billion cost of universal internet expansion in the United States [13]. The act also includes $14.2 billion to extend the existing subsidy of internet plans to low-income individuals and households. This initiative will make the performance and price gap between satellite ISPs and terrestrial ISPs harder to close.

Key Takeaways

Given the current landscape of the internet industry and our short-term projections, we expect to see satellite internet as a complement to terrestrial broadband rather than a complete replacement. Terrestrial broadband has advantages in speed, cost, reliability, latency, and data caps. Therefore, for satellite internet to be fully competitive as a replacement for these services, ISPs would have to make significant improvements in speed offerings, latency reductions, and most importantly cost. Meanwhile, terrestrial ISPs are reaping the benefits of government investment and higher revenues to better their service and increase coverage.

Rural internet coverage is still an area where satellite internet can prove useful and providers can capture a percentage of the market with their existing services. However, we predict that population clusters near ground-based internet infrastructure won’t have an imperative to switch to satellite-based internet. Starlink, with its growing satellite constellation, shows promise of offering high-speed options to rural residents around the world. Compared to Viasat and HughesNet, they have readily available in-house launch capability via SpaceX’s Falcon 9 and upcoming Starship. As a result, we expect to see their service plans offer higher speeds and reduced prices as their global customer base grows quickly. Viasat and HughesNet face latency and speed limitations with GEO satellite service but could look to implement LEO + GEO combinations to better compete. These operators will face even more competition as new entrants in the market, such as Amazon, begin to offer service plans with higher speeds and lower costs.

Nevertheless, with 2.9 billion individuals around the world without internet, satellite ISPs have a legitimate business opportunity to service these markets [14]. Capturing just 1% of this market would mean 29,000,000 new customers and hundreds of millions of dollars in revenue. Terrestrial ISPs in the U.S. and abroad will look to address this issue through expanding networks, but geographic limitations especially in under-developed countries will allow satellite broadband operators to attain a substantial customer base and help bridge the global internet accessibility gap.

Hayden Magill | Economic Analyst

Mr. Hayden Magill is an Economic Analyst at SpaceWorks focusing on parametric cost estimation, business case assessments, and advanced modeling & simulation techniques for aerospace projects. Mr. Magill was the lead analyst for the NASA Commercial Hypersonic Transportation Market Study conducted with Deloitte and the Air Force Research Laboratory (AFRL) future liquid engine propulsion concepts project. While at the University of Georgia, he earned a Bachelor of Science (B.S.) in Mechanical Engineering and a STEM Master of Business Administration (MBA).

Naren Matcha | Junior Economic Analyst

Mr. Naren Matcha is an Economic Analyst intern at SpaceWorks. His experience also includes a finance internship at the Yamaha Motor Corporation. Attending the Georgia Tech Scheller College of Business, Naren is pursuing a Bachelor of Science (B.S.) in Business Administration, with a Concentration in Finance. In addition to his internship position at SpaceWorks, he is a Junior Analyst with the Georgia Tech Undergraduate Consulting Club and a Vice President of External Relations for the college’s Phi Sigma Kappa Fraternity – Kappa Deuteron Chapter.