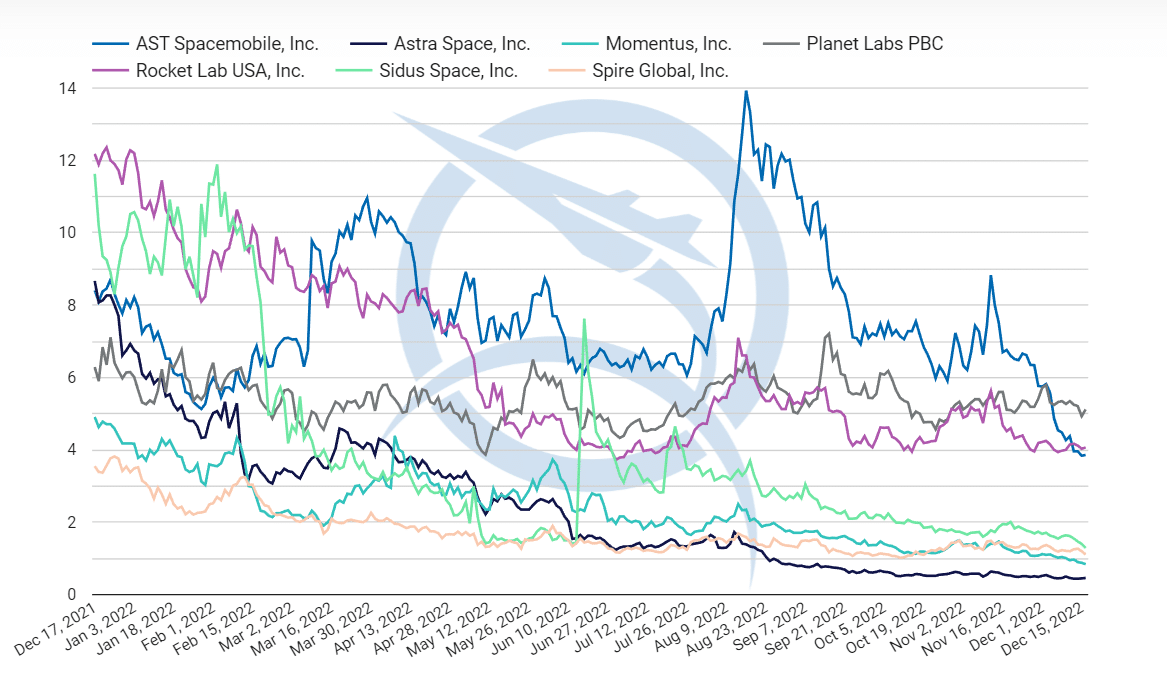

Looking back at the SpaceWorks NewSpace Index (NSI) over the course of the past year reveals underwhelming performance by virtually all of the recently public NewSpace companies. Some of our NSI companies, like AST SpaceMobile ($ASTS), showed flashes of potential while most had mediocre performances in 2022, at best. No NSI company has been able to maintain momentum on the public market for a variety of reasons. The poor performance of the US economy has not helped, but even compared to our Traditional Space Index (TSI) in a year-over-year comparison, pure play NewSpace Index companies have collectively underperformed as a group. As of December 19th, all companies, which opened at around $10 per share, are now trading below $5 per share with the exception of Satixfy ($SATX). However, after a series of dramatic rises and falls in their stock price, even Satixfy now looks like they’ll soon join the rest of the pack on a slow decline.

A few NewSpace companies are having a tougher time than others on the public market. Momentus ($MNTS) has now joined Astra ($ASTR) below the $1 per share threshold. We expect Momentus will soon receive a delisting warning and have 180 days to right the ship, which makes their upcoming flight for their second Vigoride mission even more significant following the partial failure of the first Vigoride mission. Astra is approaching the halfway point of their 180 days and is relying on space system sales to keep them afloat until Rocket 4 is ready as their stock price continues to drop. Spire Global ($SPIR) and Sidus Space ($SIDU) are the next closest to trading below $1 per share and may soon join Astra and Momentus.

As one of the few causes for optimism, Planet Lab’s ($PL) performance over the past year has been relatively flat, compared to the downward trend experienced by the rest of the NewSpace Index. Planet Lab is anticipating $189M-$192M in FY22 revenue, right in range with the $191M projection they established in 2021 in their SPAC pitch deck. Meeting or exceeding pre-SPAC projections is a rarity thus far for NewSpace companies that have SPAC-ed, and this should promote some market confidence in Planet.

Looking ahead to 2023, we anticipate that we’ll start to see a clearer separation between winning and losing public NewSpace companies. Stronger companies like Rocket Lab and Planet should be poised to execute on their business plans and hopefully the market will respond accordingly. On the flip side, some weaker companies will likely falter and seek to be acquired or just close-up shop. For most of the NSI companies in the middle, we expect more of the same: underwhelming 2023 performance with reactive spikes or drops due to major headlines but still living between $2-$8 per share. Most public NewSpace companies are reporting enough financial runway to get through 2023, so 2024 may be the year of reckoning for NewSpace companies. Time will tell.